Source: www.cra-arc.gc.ca and www.canada.ca

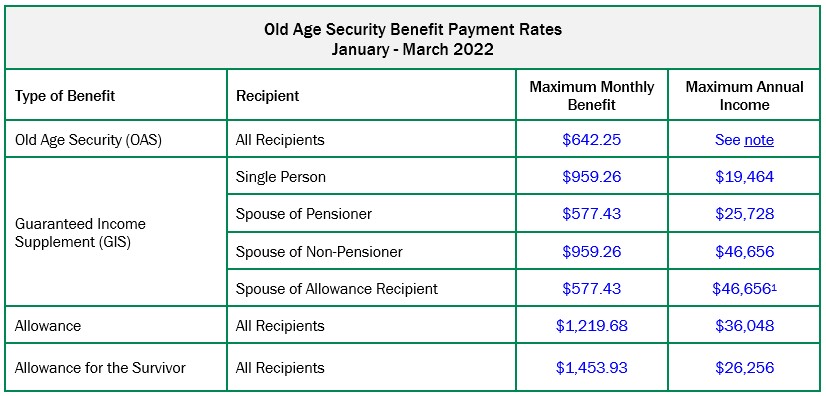

1 For Spouse of Allowance recipient, the Allowance stops being paid at $36,048 while the GIS stops being paid at $46,656.

Note: Pensioners with an individual net income above $81,761 must repay all or part of the maximum OAS pension amount. The repayment amounts are normally deducted from their monthly payments before they are issued. The full OAS pension is eliminated when a pensioner’s net income is $133,141 or above.

|

|

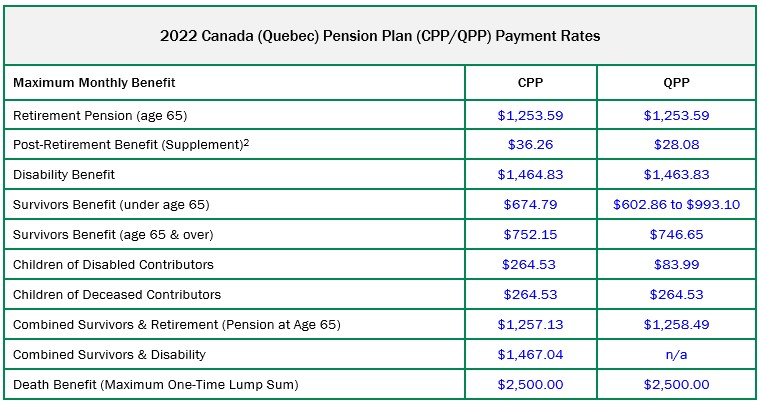

2 If you are working while collecting CPP or QPP, you may be eligible or required to contribute to CPP/QPP. These additional contributions will provide additional benefits as shown above.

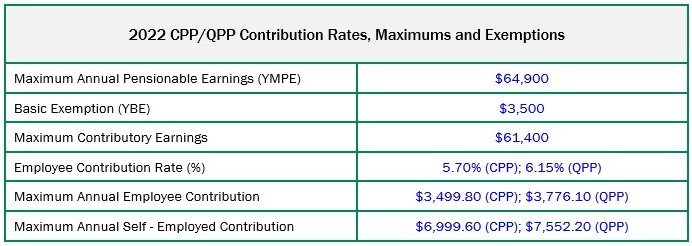

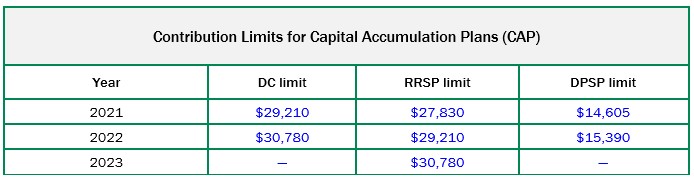

Note: Defined Contribution (DC) and Deferred Profit Sharing Plan (DPSP) purposes are also restricted to 18% of compensation.

If you have any questions regarding the above government benefits and limits, please contact our Senior Consulting Actuary and Practice Leader, June Smyth at 416-863-9159 ext 233.